Cyprus Permanent Residence

Become A Permanent Resident Of Cyprus By Investment

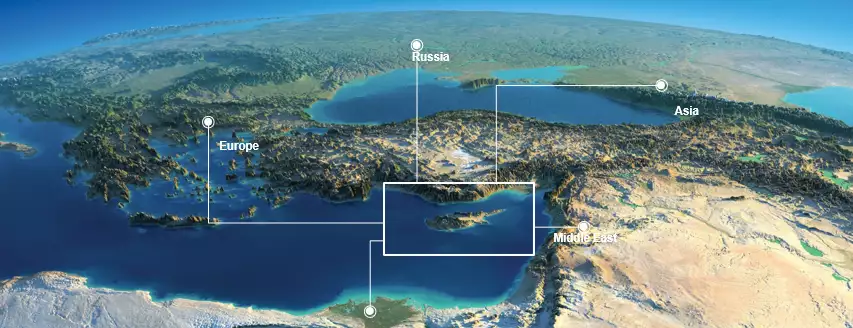

Unlocking Cyprus’ Strategic Geographical Advantage: A Gateway to Thriving Business Opportunities

Cyprus Permanent Residence : Cyprus’ remarkable competitive edge stems from its strategic geographical location, a factor that has propelled the island into a bustling business epicenter. Within its borders lies a diverse range of investment prospects, particularly in pivotal sectors driving economic growth. Discover how Cyprus’ strategic positioning has paved the way for a flourishing business hub, presenting a plethora of enticing investment possibilities.

Acquiring property in Cyprus, either as an investment or as a second home, has always been a popular choice among foreign investors. A combination of high quality of life, year-round sunshine and natural beauty, ease of doing business and investment incentives offer investors an attractive experience in terms of both living and doing business.

- Member of the EU and Euro zone

- Strategic location at the crossroads of 3 continents (Europe, Asia and Africa) Safe and secure environment

- Attractive and significant international business center

- Ability to obtain Permanent Residency / Citizenship for non-EU citizens through the purchase of real estate

- Low tax rates: Corporate (12.5%) Pensions for international (5%)

- New “Non Dom” tax residency with only 60 days minimum stay requirement Double taxation treaties with 60+ countries

- Caters to 4 million tourists per year

- High level of services including financial, medical, educational, telecommunications etc. High standard but low cost living

- Growth sectors and opportunities (Real Estate, Natural Gas, Tourism, Health, Education and Shipping)

- The recent natural gas discovery with be a game changer for the economy Largest casino integrated resort in Europe

CYPRUS

FACTS AND FIGURES

| Safest country in the world among small countries and 5th worldwide (2016) | 4th out of 144 countries on higher education and training (2016) | Best relocation destination in the world (2016) | Double taxation agreements with over 65 countries worldwide (2019) |

| 65 Blue Flag beaches- most per capita in the world (2019) | Days of sunshine throughout the year | Pafos 2017- European Capital of Culture | 3.97 million recorded tourists visited Cyprus in 2019 |

Cyprus Tax Incentives

0%

- Immovable Property Tax

- Inheritance, Wealth and Gi Tax

- On dividend income for non-Cypriots On Widow’s pension

- First €19.500 are exempt from personal income tax

- Instead of 8%, zero property transfer fees on vatable properties

5%

- On foreign pensions, exemption of €3.417 is granted

- A reduced VAT (5% from 19%) for main residence purchased

12.5%

- Corporate tax, one of the lowest in Europe

NON DOM Residence persons have high exemptions from many taxes and rates for their Cyprus and non-Cyprus income

Requirements And Conditions -Cyprus Permanent Residence

- Accelerated process (only 2 months) from the date of the submission of the application.

- No need to reside in Cyprus as long as the applicant and his family included in the Immigration Permit, visit Cyprus at least once every two years.

- The applicant should be an owner of a property (sold for the first time by a development company) in Cyprus, a house, an apartment or any other building, for a minimum value of €300.000 + VAT (if any).

- Also they can purchase of other types of real estate such as offices, shops, hotels or similar developments or a combination of these with a total value of € 300,000. These properties can also be second hand properties.

- The immigration permit issued to an applicant covers his spouse and children under the age of 18. The said permit is also applicable for unmarried children aged 18 to 25 who may prove that they are students at a University and are financially dependent on the applicant. The said permit will be valid for life a er the age of 25 without any other supportive document.

- Documentation as proof that the applicant and/or his spouse have a secured minimum annual income of €30.000, (increase by €5,000 for each dependent person) from sources originating from abroad (salaries, pensions, dividends, fixed deposits, rents a.s.o.).

- The parents of the main applicant and those of his spouse are also able to apply and obtain the Permanent Residence Permit by just showing an extra 8,000 euros each on the main applicant’s income certificate.

- The applicant and his family included in the Immigration Permit must submit with their application, all documentation needed as per the checklists provided by the Cyprus Government

- The applicant and his spouse shall confirm that they do not intend to be employed in Cyprus but it is to be noted that the applicant and/or his spouse may be a shareholder(s) in a Company registered in Cyprus and the income from the dividends of such a company in Cyprus are not deemed an impediment for the purpose of obtaining an immigration permit.

Cyprus Permanent Residence-Benefits

- Cyprus Residence Permit is permanent and no need for future reconsideration. It is a lifetime permit.

- Cyprus Permanent Residence applies to the entire family (parents, children, grandparents).

- Cyprus Permanent Residents have the right (under certain conditions) to apply for a Cypriot passport following their physical presence for a total of 5 years within a 7 year period.

- Once the Cyprus Permanent Residence Permit is obtained the applicant and his family included in his Immigration permit will be entitled to apply for a Schengen Visa through any Schengen European Embassy.

- It is very important to note that Cyprus is expected to enter the Schengen Zone soon.

- Cyprus has a relaxed, stress-free lifestyle with the lowest crime rate in Europe

- Cyprus has zero Inheritance, wealth, gi and immovable property tax

- Cyprus offers an ideal family environment, enabling your children to benefit from excellent schools and universities while healthcare and infrastructure are all state-of-the-art

- Cyprus is one of the most popular destinations for setting up companies with only a 12.5% corporate tax rate, and double taxation treaties with almost 65 countries

- Risk free Freehold property ensures permanent property rights

Related: SGA World Cyprus